How Will I Lose My Tax Refund When Filing Bankruptcy can Save You Time, Stress, and Money.

You will have an even better prospect of affording your costs in the 12 months when you had been to get more money Every paycheck.

Irrespective of whether you have got truly gained your refund in hand or are still waiting around within the refund, the money is still regarded as house of the bankruptcy estate. When you've got not nonetheless been given the tax refund, you should inquire as as to whether you will have the capacity to exempt it underneath one of the federal or point out exemption statutes.

The complex storage or accessibility is needed for the legit reason of storing preferences that aren't asked for because of the subscriber or user.

Observe that luxury buys, repayment of loans to friends and family and bank card payments are usually not on the above mentioned list of important residing costs. These are generally not great approaches to spend your tax refund. The trustee could perspective these transactions as poor faith or even a preferential therapy of creditors.

We’ve also highlighted the importance of strategic preparing and informed decision-making, significantly in the way you handle your tax refund prior to and following filing for bankruptcy.

Initial, locate a bankruptcy attorney who will provide you with a cost-free evaluation and estimate on Anything you’ll should pay out to file.

Invoice and Kathy had to repay the courtroom charges and again taxes they owed. They had to be current on their own mortgage loan and auto payments. The judge click to read more discharged fifty percent in their charge card financial debt.

Lawful and Expert Service fees: In the event you incur legal or other Expert expenses relevant to your bankruptcy, they're frequently not deductible on your personal tax return.

In a very Chapter seven bankruptcy, specified kinds of older tax debts might be discharged, whilst in Chapter 13 bankruptcy, see post tax debts are often included in the repayment strategy, which lets the debtor to pay for them over a period of time.

Here is a proof for how we earn money . Our Bankrate guarantee is to make sure almost everything we publish is objective, exact her comment is here and honest.

The affect of bankruptcy in your tax return can be shaped by the kind of bankruptcy chapter filed. Chapter seven bankruptcy, also called "liquidation bankruptcy," and Chapter thirteen bankruptcy, often often called "reorganization bankruptcy," deal with tax debts otherwise.

When you file for bankruptcy, the Internal look at this web-site Income Services (IRS) is notified as A part of the conventional treatment to tell all creditors of Recommended Reading the bankruptcy position. That is a crucial action in the procedure, because it triggers the automatic remain, a authorized provision that halts most assortment endeavours by creditors, including the IRS.

However it’s a practical possibility for those who don’t need to liquidate your belongings, as demanded in Chapter 7, or if you have excessive debt to qualify for Chapter thirteen.

Nonetheless, In the event the debt is related to dischargeable taxes, then the garnishment will not resume as the financial debt will be eliminated.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Marla Sokoloff Then & Now!

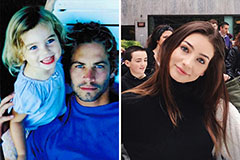

Marla Sokoloff Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!